Your Preferred Mortgage Solution in New York, Pennsylvania.

We’re experts in the mortgage market and commercial lending, with years of experience working alongside homebuyers, real estate agents to deliver a smooth, stress-free residential and commercial financing experience.

About Netter LLC.

At NETTER LLC, we’re committed to making your mortgage journey simple and straightforward. Our experienced team delivers personalized guidance, competitive options, and a smooth process from application to closing—so you can move forward with confidence.

A Seamless Process

-

Discover your rate.

Instantly compare top offers from more than 25 trusted lenders in our network and secure the deal that fits you best.

-

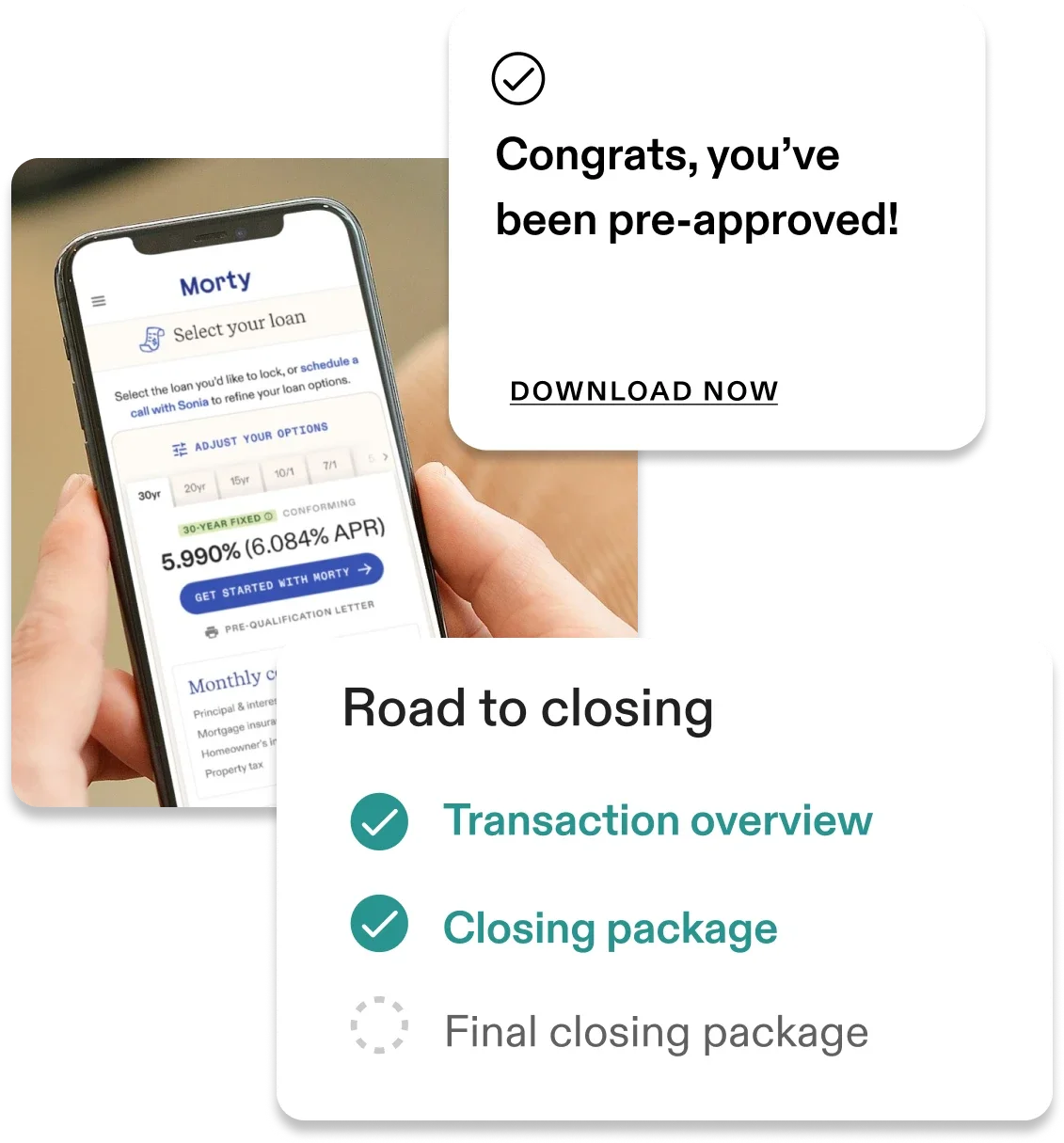

Get pre-approved.

Complete a quick online application and receive fast approval, giving you the leverage you need in your home search.

-

Close with ease.

A streamlined mortgage closing supported by digital tools and expert guidance, making the final steps fast and stress-free.

Mortgage Rates Today

We sort through thousands of loan options so you don’t have to. Access competitive rates on 15, 20, and 30-year fixed loans, 10/6, 7/6, and 5/6 ARMs, FHA, Jumbo, low–down-payment programs, and more. Create an account to personalize your loan choices and stay updated with daily rate trends.

Homebuying Resources

Real Experiences from Real Homebuyers

FAQs

-

A second home is a place you plan to use personally for part of the year. An investment property is purchased primarily to generate income—through renting, resale, or long-term value growth.

-

No. Lenders don’t allow projected rental income to help you qualify for a second-home loan. Rental income can sometimes count for investment properties, but lenders usually want proof that you can successfully manage rental units.

-

Second homes often require at least 10% down, while investment properties typically require 20–30% down. Since mortgage insurance isn’t available for these purchases, lenders expect stronger financial footing.

-

Yes. Because these properties carry more risk for lenders, rates are generally higher than those for primary residences.

-

Often you can—but only for a limited number of days each year. Going beyond your loan’s rental restrictions may violate your mortgage agreement, so you should always review the lender’s rules before listing the property.